Managing money can be confusing, especially when it comes to budgeting. Have you ever wondered how to take control of your spending and savings? The 50/30/20 rule might be just what you need!

This easy-to-follow budgeting method breaks down your finances into three simple categories, making it easier to reach your financial goals. By using the 50/30/20 rule, you can organize your money, reduce debt, and save for the future, all while keeping it straightforward.

What is the 50/30/20 Rule?

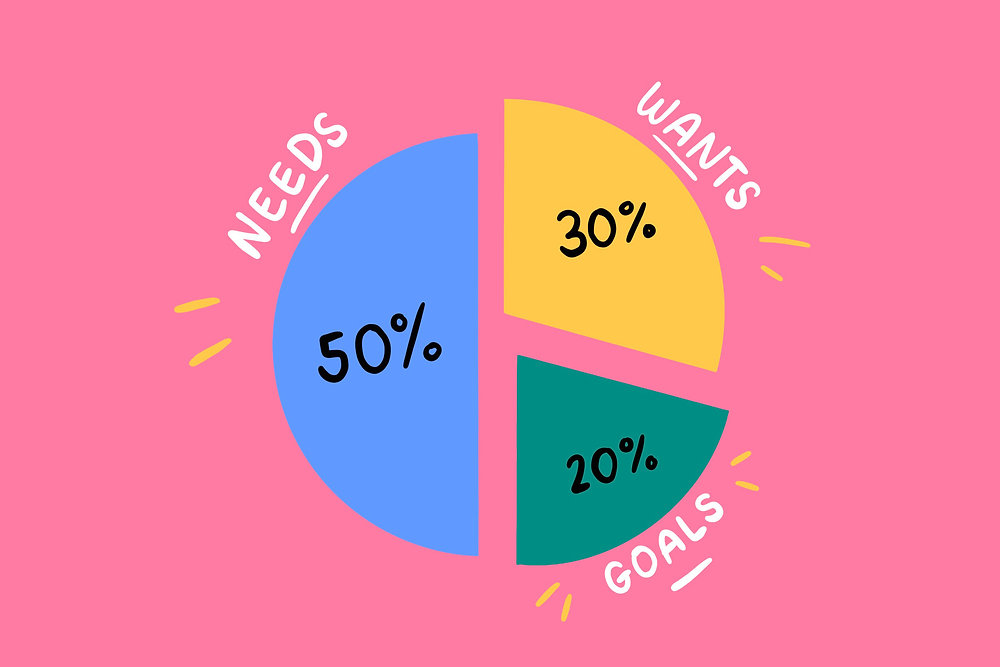

The 50/30/20 rule is a budgeting guideline that helps you divide your income into three categories: needs, wants, and savings. This method states that you should spend 50% of your after-tax income on needs, 30% on wants, and 20% on savings and debt repayment. This simple approach makes it easy to track where your money goes each month.

Understanding Needs (50%)

Needs are the essential expenses that you cannot live without. They include things like:

- Housing: Rent or mortgage payments

- Utilities: Electricity, water, and internet bills

- Groceries: Food and essential supplies

- Transportation: Gas or public transportation costs

- Insurance: Health, car, or home insurance

These essentials should make up no more than 50% of your total income. If your needs take up more than this amount, it might be time to look for ways to cut back.

Spending on Wants (30%)

Wants are the things that make life enjoyable but are not necessary for survival. This might include:

- Dining out at restaurants

- Hobbies and entertainment, like movies or games

- New clothes and accessories

- Subscription services like Spotify or Netflix

Allocating 30% of your income towards these wants allows you to live a balanced life while still keeping your finances in check. Just be mindful, as overspending in this category can lead to debt problems.

Saving and Debt Repayment (20%)

The final part of the 50/30/20 rule focuses on saving and paying off debt. This section includes:

- Building an emergency fund

- Retirement savings

- Paying off credit card debt or student loans

Saving 20% of your income can help you prepare for future financial needs and keep you out of debt. It’s important to create a plan for how you will allocate this 20% depending on your personal financial goals.

How to Implement the 50/30/20 Rule

Using the 50/30/20 rule in your budgeting is simple and can lead to better financial habits.

Start with your total after-tax income. Keep track of where your money goes for a month. Allocate your income into the three categories based on the 50/30/20 guideline.

Benefits of the 50/30/20 Rule

Following the 50/30/20 rule has several benefits. It provides a clear framework for spending and saving. It allows for personal choice in how you want to spend your money.

Helps reduce stress by ensuring you are saving and covering your essential expenses. By following the 50/30/20 rule, you’ll find it easier to manage your finances, leading to a healthier financial life. Remember the next time you think about budgeting, consider how the 50 30 20 rule can open doors to financial freedom.

Get Started with Budgeting Today!

Now that you understand the basics of the 50/30/20 rule, it’s time to take control of your budgeting. This method is easy to use, and once you apply it, you’ll feel more confident about your finances.

For more helpful tips, check out the rest of our site today.

Dilawar Mughal is an accomplished author with a passion for storytelling. His works span various genres, from thrilling mysteries to heartfelt romance novels. With a keen eye for detail and a knack for character development, Sana Fatima weaves engaging narratives that captivate readers and transport them to new worlds.